Investing & Trading: Real Strategies for Modern Investors

When you think about investing & trading, the act of putting money to work in financial markets to grow wealth over time or profit from price movements. Also known as market participation, it’s not about getting rich quick—it’s about making smart, repeatable choices that add up. Most people get stuck because they treat it like a casino. But real investors and traders treat it like a skill—one you build with practice, tools, and clear rules.

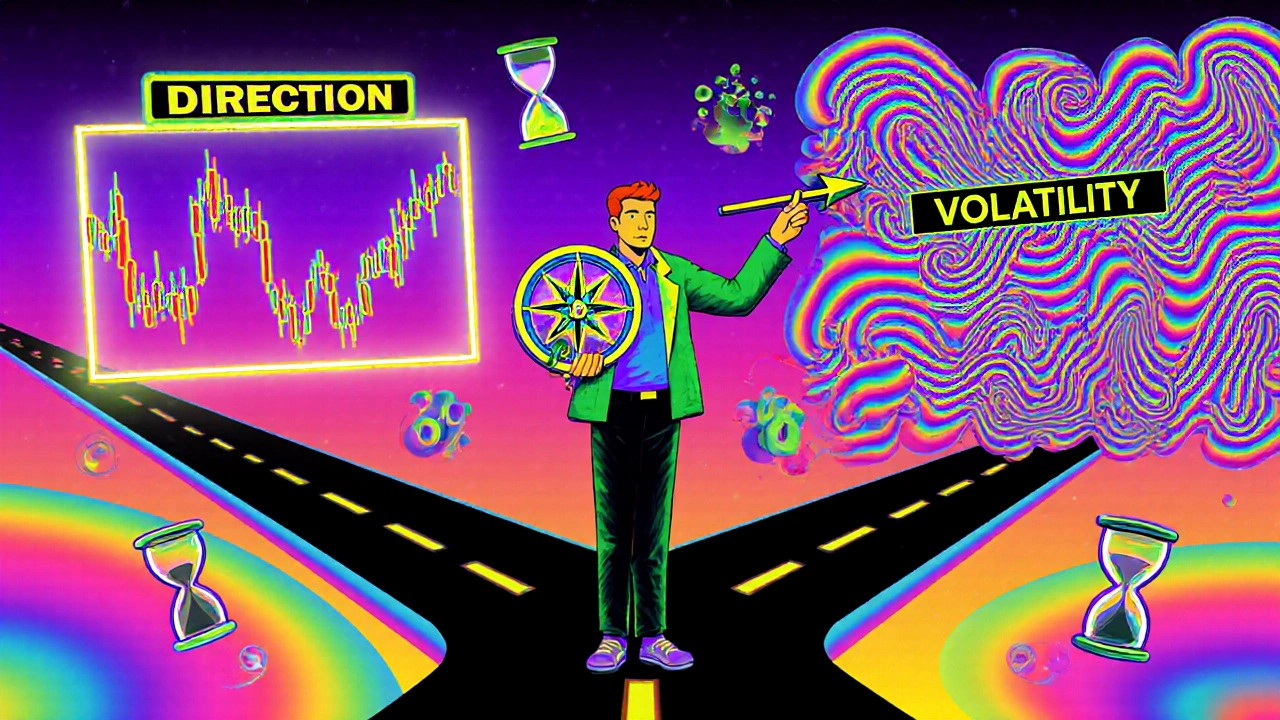

Directional bets, trades that profit when an asset moves up or down in price are the foundation. Think buying a stock because you believe it’ll rise, or shorting it because you think it’ll fall. Simple? Yes. Hard to do consistently? Absolutely. Then there’s volatility plays, strategies that profit from price swings, not just direction. These aren’t for everyone. They need timing, patience, and a solid grasp of how options work. That’s why so many traders lose money trying to combine both without understanding the difference.

What separates the people who sleep well from those who stare at their screens at 2 a.m.? It’s not luck. It’s knowing when to use a bull call spread versus a long straddle, understanding how fees eat into returns, and having a system that doesn’t rely on gut feelings. You don’t need to predict the market. You just need to know what to do when it moves—and when to sit still.

This collection cuts through the noise. You’ll find straight talk on how options actually work, what drives volatility, and why most trading guides fail to deliver real results. No fluff. No jargon. Just the tools, tactics, and mindset shifts that help you make better decisions—so you can stop worrying and start moving forward.