Social Media Security Score Checker

How Secure Are Your Social Media Accounts?

This tool helps you assess your social media security level based on best practices from the latest security research. Find out how vulnerable you are to scams and get personalized recommendations to protect your accounts.

Answer these questions to calculate your security score:

Your Security Score

0

Not Secure

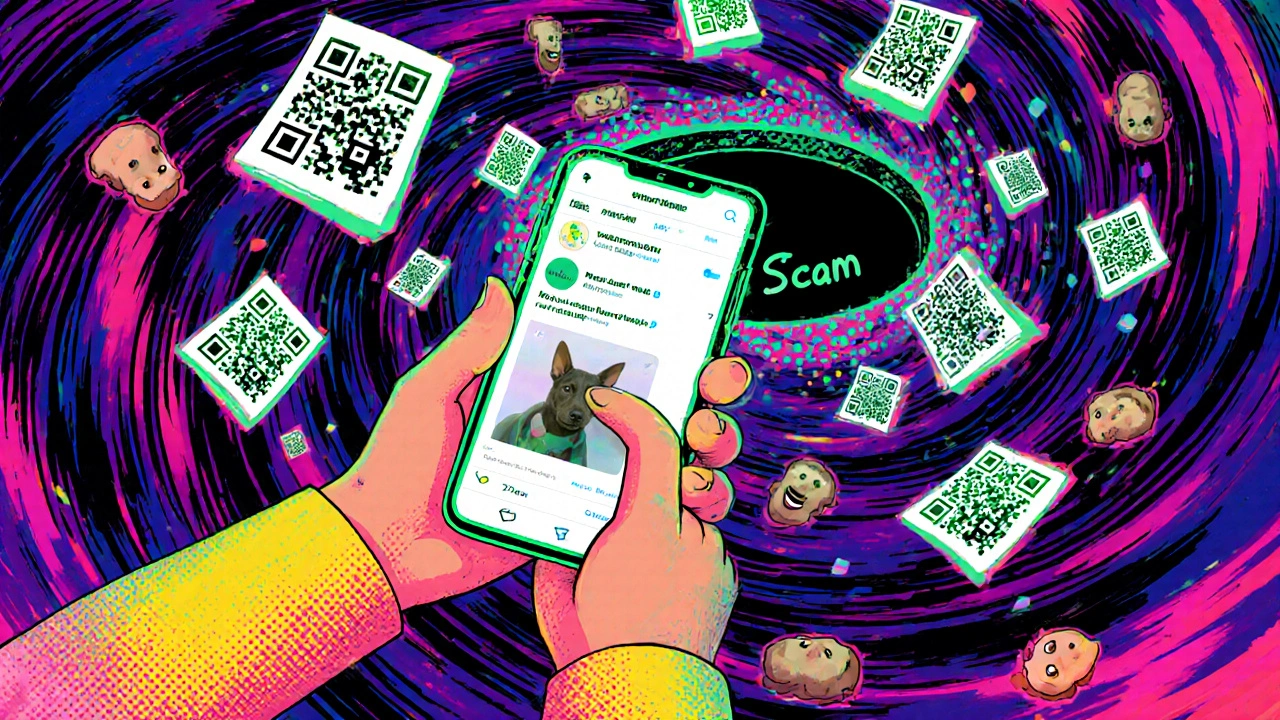

Every day, millions of people open their social media apps expecting to see updates from friends, funny videos, or maybe a new product they’re curious about. But hidden in those feeds are traps designed to steal your money, your identity, or both. In 2025, social media scams aren’t just annoying-they’re more sophisticated, faster, and deadlier than ever. You don’t need to be tech-savvy to fall for them. You just need to be human.

How Scammers Are Trickier Than Ever

Five years ago, a scam might’ve been a poorly spelled message saying, “You won $10,000!” Now, scammers use AI to clone voices, mimic your cousin’s writing style, and build fake profiles that look real enough to fool even careful users. According to McAfee’s 2025 threat report, 63% of social media scams now use QR codes-called “quishing”-that look like harmless links but lead to fake login pages that copy the real thing with 92% accuracy. These aren’t random attacks. Scammers study your public posts. If you’ve shared your dog’s name, your high school, or your birthdate, they’re using that to answer your security questions. Experian’s 2024 identity report found that 73% of account takeovers happen because scammers guessed answers to security questions using information you posted online. And it’s not just Facebook or Instagram. Scammers are moving to WhatsApp and Telegram because those apps don’t flag suspicious messages like email does. The FTC says 41% of social media phishing attempts now start there. Once you click a link, they’re in your account-maybe even your bank.The Fake Job Scam That’s Cleaning Out Bank Accounts

One of the fastest-growing scams right now is fake job offers. You see a post on LinkedIn or Facebook: “Work from home. $25/hour. No experience needed.” It looks legit. The profile has a company logo, fake testimonials, even a professional-looking website. Google’s November 2025 advisory says they block 15 million of these fake job ads every month. And 68% of them ask for your Social Security number under the guise of “onboarding.” That’s not how real companies operate. Legit employers don’t ask for your SSN until after you’ve been hired and signed paperwork. Charles Schwab’s 2025 survey found that 78% of investment scams on social media use fake profiles pretending to be financial advisors. These “advisors” push you to send money to a fake crypto wallet or trading platform. Once you deposit, the site vanishes. Victims lose an average of $8,200 per incident. Reddit user u/SafeSurfer99 lost $3,500 in October 2025 after being contacted by a fake influencer who promised a paid partnership. The profile had 12,000 followers, 87 posts, and a verified badge-faked with tools anyone can buy online.Your Privacy Settings Are Your First Line of Defense

You can’t stop scammers from trying. But you can make it way harder for them to succeed. Start with your privacy settings. Go to each of your major accounts-Facebook, Instagram, Twitter/X-and set your profile to private. Turn off public access to your birthdate, location history, and tagged photos. Limit who can see your friends list. Why? Because scammers use your network to find targets. If your friend’s account gets hacked, they’ll message your friends using your name. The Social Security Administration recommends reviewing your privacy settings every three months. That’s not optional-it’s essential. You wouldn’t leave your front door unlocked. Don’t leave your digital life wide open. And stop posting personal details. “Happy birthday to my daughter, Emily!”-that’s a gift to scammers. Your pet’s name? Your mom’s maiden name? Those are common security question answers. Experian found that 73% of account breaches used publicly shared info to reset passwords.

Stop Using SMS for Two-Factor Authentication

Two-factor authentication (2FA) sounds like a good idea-and it is. But if you’re using SMS codes, you’re still vulnerable. Scammers can perform SIM swapping: they call your phone provider, pretend to be you, and get your number transferred to a new SIM card. Then they get your 2FA codes. The FBI reported a 22% increase in SIM swapping attacks in 2024. Switch to an authenticator app like Google Authenticator, Authy, or Microsoft Authenticator. These apps generate codes on your device-no phone number needed. Even better: use passkeys. Google says passkeys are 99.7% effective against phishing. They’re digital keys stored on your phone or computer that can’t be copied or stolen like passwords. If a scammer sends you a fake login page, your passkey won’t work. It only unlocks on your trusted device. As of November 2025, 41% of major platforms-including Apple, Google, and Meta-support passkeys. That number will hit 89% by 2027. Start using them now.Passwords Are Dead. Use a Password Manager.

Reusing passwords is the #1 reason people lose accounts. The SSA says 65% of account takeovers happen because someone used the same password on multiple sites. Stop writing passwords on sticky notes. Stop using “Password123.” Start using a password manager. Consumer Reports tested 12 password managers in November 2025. Bitwarden and 1Password blocked 100% of credential-stuffing attacks in their simulations. A password manager doesn’t just store your passwords. It generates strong, random ones for every site. You only need to remember one master password. And yes, it’s safe. These tools use zero-knowledge encryption-meaning even the company can’t see your data. Set your passwords to be at least 12 characters long, with uppercase, lowercase, numbers, and symbols. That’s the new minimum. Anything less is like locking your house with a rubber band.

Comments

I’ve been using passkeys for six months now and honestly? Life’s easier. No more guessing which password I used for that one site in 2017. My phone just unlocks everything. And the best part? My mom finally stopped sending me ‘urgent’ WhatsApp messages from ‘my cousin’-she now asks for the pineapple.

Also, switched to Bitwarden. It’s free, open-source, and doesn’t feel like a spy app. Seriously, if you’re still using ‘Password123’-please, just stop. Your dog’s name isn’t a secure answer.

QUISHING?? Bro, I just scanned a QR code at a coffee shop last week and thought it was for the loyalty program. Now I’m paranoid every time I see one. And yeah, fake job scams are wild-I saw one offering $30/hr to ‘manage crypto portfolios’ from my couch. The profile had a LinkedIn badge, a fake Forbes article, and a guy in a suit holding a golden laptop. I reported it. But seriously, how are people still falling for this? They’re not even trying to be convincing anymore.

Also, SIM swapping is terrifying. My cousin got hacked last month and they drained his Venmo using his 2FA code. He didn’t even know his number was stolen until his phone died. Authenticator apps are non-negotiable now. No exceptions.

Let me be blunt: if you’re still relying on SMS for 2FA, you’re not just careless-you’re endangering your entire digital ecosystem. This isn’t a ‘maybe’ or a ‘you should.’ It’s a fucking emergency. The FBI data isn’t a suggestion-it’s a death toll waiting to happen.

And don’t get me started on those ‘verified’ influencer accounts. I’ve seen fake profiles with 15k followers, 300+ posts, and a blue check that cost $12 on Fiverr. People send them thousands because they ‘look legit.’ Legit? No. They’re algorithmically engineered predators. The platforms are complicit. They make money off engagement, not safety. Until they’re legally forced to verify identities, this will keep getting worse.

And yes-I use passkeys. I use Bitwarden. I use a safe word with my family. I don’t post my birthday. I don’t tag my kid’s school. I don’t click links. If you’re not doing these things, you’re not protecting yourself-you’re just hoping for luck. Luck is not a security protocol.

It is truly fascinating, and somewhat sobering, to observe how our digital identities have become not merely extensions of ourselves but rather fragile, exposed artifacts in a landscape increasingly dominated by algorithmic deception. The notion that our most intimate details-our pet’s name, our mother’s maiden name, our childhood home-are now commodified by malicious actors using AI-driven data aggregation is not science fiction; it is the mundane reality of 2025.

And yet, there is a quiet dignity in the simplest defenses: the safe word, the password manager, the passkey. These are not technological miracles, but acts of intentional care-small, consistent rituals that reclaim agency in a world that seeks to dissolve boundaries. One might argue that these habits are not merely protective, but deeply human: they require patience, discipline, and the courage to say no-even when the message appears to come from someone you love.

I have often wondered whether the true vulnerability lies not in our passwords, but in our trust. We are wired to connect, to believe in the authenticity of others. Scammers exploit this not by hacking systems, but by hacking hearts. Perhaps the most powerful tool we possess is not encryption, but discernment.

Still, I am hopeful. The rise of passkeys, the legal frameworks emerging abroad, the growing public awareness-these are not just patches, but a new foundation. We are learning, slowly, to live with our devices without surrendering our souls to them. And that, perhaps, is the most important update of all.