When the market drops, most people panic. They sell. They chase the next hot stock. They think they’re saving themselves-until they realize they’ve locked in losses and missed the rebound. But there’s another way. Defensive investing isn’t about timing the market. It’s about building a portfolio that doesn’t break when the market does. It’s about holding stocks and assets that keep working, even when everyone else is scared.

What Makes a Stock Defensive?

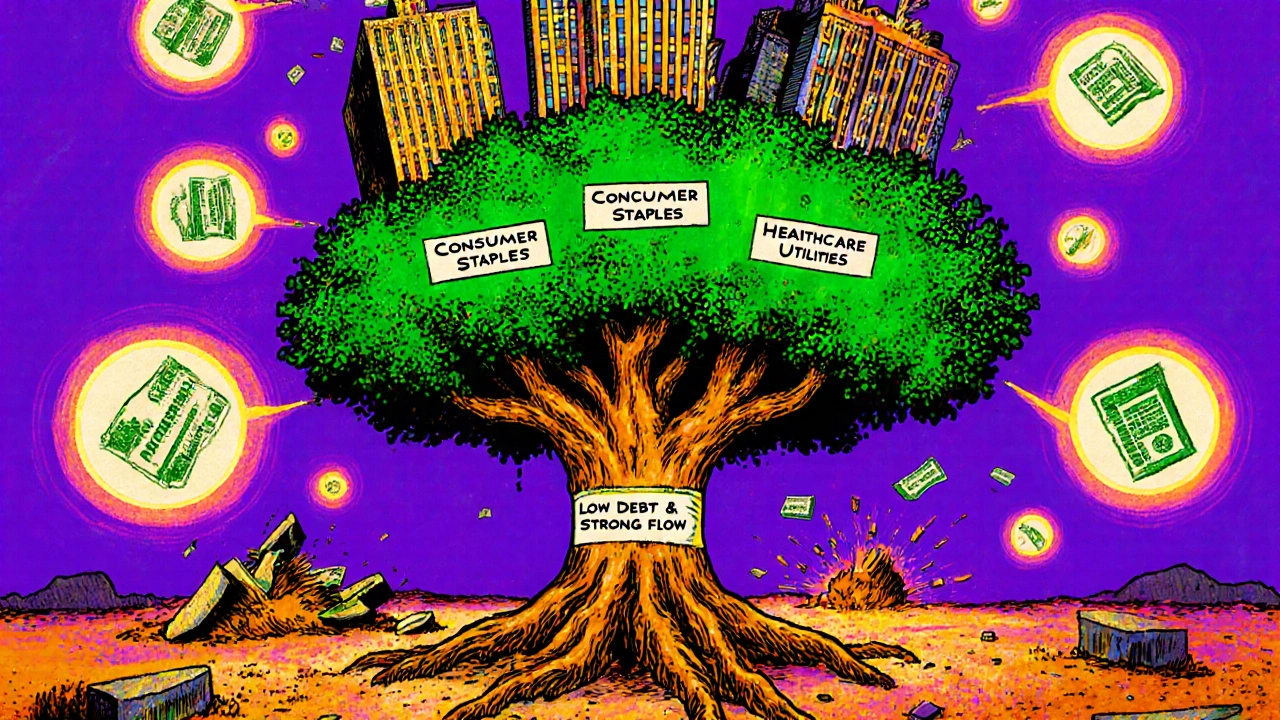

Not all stocks are created equal during a downturn. A defensive stock isn’t just cheap or low-priced. It’s a company that keeps making money no matter what’s happening in the economy. These are businesses people always need: food, medicine, power, water, basic household goods. You don’t stop buying toilet paper when the economy crashes. You don’t skip your prescriptions. You still turn on the lights. Companies with strong defensive stocks share a few key traits:- Low debt: They don’t rely on borrowing to survive. When interest rates rise or credit tightens, highly leveraged companies struggle. Defensive firms have clean balance sheets.

- Consistent earnings: Their profits don’t swing wildly from quarter to quarter. They make money even in recessions.

- Strong cash flow: They generate more cash than they spend. That means they can pay dividends, invest in their business, or just sit tight during tough times.

- Low volatility: Their stock prices don’t jump up and down with every news headline. They move slower, steadier.

According to Charles Schwab’s research from 2023, companies with these traits outperformed high-volatility stocks by 8.2% annually during recessions between 2000 and 2023. That’s not a small edge. That’s the difference between losing 10% and gaining 2% when the market is falling.

Which Sectors Are Truly Defensive?

Some sectors have a long track record of holding up when everything else is crashing. These aren’t guesses. They’re facts backed by data since 1970.- Consumer staples: Think Procter & Gamble, Coca-Cola, Walmart. People keep buying shampoo, toothpaste, and cereal-even when they cut back on vacations or new cars.

- Healthcare: Hospitals, drug manufacturers, medical device makers. Demand for medicine doesn’t disappear during a recession. In fact, it often increases as people lose jobs and rely more on public health systems.

- Utilities: Electricity, gas, water providers. These are regulated monopolies. They don’t compete on price. They just keep the lights on-and get paid for it.

Merrill Lynch’s 2024 market guide shows these three sectors outperformed the broader market by 4-7% annually during recessions over the past 50 years. That’s not luck. It’s structure. These businesses have pricing power, steady demand, and predictable costs.

During the 2020 pandemic crash, healthcare stocks had a beta of just 0.75-meaning they moved 25% less than the S&P 500. Utilities and consumer staples were close behind. Meanwhile, tech stocks with no profits and high debt plunged. The lesson? Not all growth is good growth.

Why Bonds Belong in a Defensive Portfolio

Stocks aren’t the only tool. Bonds, especially U.S. Treasuries, are the quiet heroes of defensive investing.When stocks fall, investors run to safety. That drives up bond prices and lowers yields. Since 2000, 10-year U.S. Treasury bonds have had a negative correlation of -0.43 with the stock market during periods of stress. That means when the S&P 500 drops 10%, Treasuries often rise 4-5%. That’s not a coincidence. It’s a design.

Fidelity’s research shows that during the 2020 market crash, portfolios with 40-60% in defensive stocks and high-quality bonds saw drawdowns that were 30% smaller than the overall market. And here’s the kicker-they still captured 65-75% of the rebound when things turned around. You don’t need to be 100% in stocks to grow your money. You just need to be in the right ones.

For inflation protection, Treasury Inflation-Protected Securities (TIPS) have become essential. Since their launch in 1997, TIPS have shown a 0.68 correlation with inflation. That means when prices rise, your principal and interest payments rise too. Traditional bonds don’t do that. In a high-inflation environment, TIPS aren’t just smart-they’re necessary.

Defensive Investing vs. Growth Investing: The Trade-Off

Let’s be honest. Defensive investing doesn’t make you rich fast. It doesn’t turn $10,000 into $50,000 in two years like a speculative tech stock might. But it also doesn’t turn $10,000 into $5,000 when the market crashes.During the bull market from 2019 to 2021, defensive portfolios underperformed aggressive growth portfolios by 5-7% per year. That’s painful to watch. Your neighbor’s crypto portfolio doubled. Your dividend stocks barely moved.

Then came 2022. The market dropped nearly 20%. Growth stocks collapsed. Defensive portfolios? They lost only 8-10%. That’s a 12-18% outperformance in just one year. The gap isn’t just theoretical. It’s measurable. And it’s life-changing for retirees, near-retirees, or anyone who can’t afford to wait five years to break even.

Warren Buffett once said, “Diversification is a protection against ignorance.” That’s the heart of defensive investing. You’re not trying to pick the next Amazon. You’re protecting yourself from the next mistake-yours or someone else’s.

How Much Should You Allocate?

There’s no one-size-fits-all answer. But there are proven guidelines.The IFW’s 2024 research suggests a simple rule: Protect a percentage of your portfolio equal to your age. So if you’re 45, protect 45% of your assets in defensive stocks and bonds. If you’re 65, protect 65%. That’s not a hard rule-it’s a starting point.

For younger investors (under 40), you can afford more risk. But even then, 60-70% of your equity exposure should be in defensive sectors. That means if you have $100,000 in stocks, $60,000-$70,000 should be in staples, healthcare, and utilities.

For those over 65, 40-60% of your portfolio should be in bonds and cash equivalents. That’s not being old-fashioned. It’s being realistic. You don’t have 20 years to wait for a recovery. Your income needs to be reliable.

Prospero.ai recommends a moderate defensive portfolio looks like this:

- 30-50% in dividend-paying stocks (defensive sectors)

- 40-60% in investment-grade bonds (U.S. Treasuries, corporate bonds)

- 5-10% in cash or short-term reserves

This mix doesn’t promise sky-high returns. But it does promise survival. And survival gives you the chance to grow again later.

How to Build Your Defensive Portfolio

You don’t need to pick individual stocks. You don’t need to time the market. You just need a plan.- Start with your cash. Keep 6-12 months of living expenses in a savings account or money market fund. That way, you never have to sell stocks at a loss to pay the rent.

- Use index funds. Instead of picking single stocks, buy ETFs that track defensive sectors: XLP (Consumer Staples), XLV (Healthcare), XLU (Utilities). Low cost. Instant diversification.

- Add TIPS. Buy a Treasury Inflation-Protected Securities fund like TIP or SCHP. Protect yourself from rising prices.

- Stick to your allocation. Charles Schwab advises never deviating from your target allocation by more than 5 percentage points. Don’t panic-sell when the market drops. Don’t chase returns when it rises.

- Rebalance annually. If your bond allocation grew to 70% because stocks fell, sell some bonds and buy more stocks. You’re buying low and selling high-without the guesswork.

Building this portfolio takes time. Prospero.ai says most investors need 3-6 months of gradual shifts-not a sudden overhaul. Don’t try to fix everything in one week. Make small, steady moves.

The Hidden Risk: Staying Too Defensive

Defensive investing isn’t about hiding. It’s about preparing. If you go 100% defensive and stay there for 10 years, you’ll likely fall behind inflation. You’ll miss out on long-term growth.The biggest danger isn’t losing money in a crash. It’s missing the recovery because you’re too scared to get back in. That’s why defensive investing isn’t a permanent state. It’s a strategy for navigating uncertainty-not avoiding it.

Look at the data: defensive sectors outperformed the broader market in 83% of recessionary periods since 1970. That’s not a fluke. That’s a pattern. But it only works if you’re in the market when the rebound starts.

Is Defensive Investing Right for You?

Ask yourself:- Do you need your money to be safe in the next 5-10 years?

- Are you retiring soon, or already retired?

- Do you panic when your portfolio drops 10%?

- Do you have a steady income, or are you relying on investments for living expenses?

If you answered yes to any of these, defensive investing isn’t just a good idea-it’s essential.

If you’re young, have a high income, and can ride out a 30% drop? You can afford to take more risk. But even then, having a core of defensive assets gives you peace of mind. And peace of mind means you won’t make emotional mistakes.

Defensive investing doesn’t make you a genius. It makes you resilient. And in the long run, resilience beats brilliance every time.

What are the best stocks for a defensive portfolio?

The best defensive stocks are from sectors with steady demand: consumer staples (like Procter & Gamble, Coca-Cola), healthcare (like Johnson & Johnson, UnitedHealth), and utilities (like Duke Energy, NextEra Energy). Look for companies with low debt, consistent earnings, strong cash flow, and a history of paying dividends. ETFs like XLP, XLV, and XLU offer instant diversification without picking individual stocks.

Do defensive stocks perform well in a bull market?

Not as well as growth stocks. During bull markets like 2019-2021, defensive portfolios typically underperformed aggressive growth portfolios by 5-7% annually. But that’s the trade-off. Defensive investing sacrifices some upside to avoid big losses during downturns. When the market crashes, those same portfolios often outperform by 12-18%.

Should I include bonds in my defensive portfolio?

Yes. U.S. Treasury bonds, especially 10-year notes, have historically moved in the opposite direction of stocks during market stress. Since 2000, they’ve had a -0.43 correlation with the S&P 500 during downturns. Adding bonds reduces overall portfolio volatility and provides liquidity when stocks are falling. TIPS are also critical for protecting against inflation.

How much of my portfolio should be defensive?

A common rule is to protect a percentage of your portfolio equal to your age. A 50-year-old should have about 50% in defensive assets. Younger investors (under 40) can hold 60-70% of their equity in defensive sectors, while those over 65 should aim for 40-60% in bonds and cash. The goal is to match your risk tolerance to your time horizon.

Is defensive investing only for older investors?

No. Even young investors benefit from defensive assets. They provide stability during market swings and prevent emotional decisions. A 25-year-old with 90% in equities should still allocate 60-70% of that equity portion to defensive sectors. This doesn’t limit growth-it protects your ability to stay invested through volatility.

What’s the biggest mistake people make with defensive investing?

The biggest mistake is thinking it’s about avoiding the market entirely. Defensive investing isn’t about hiding. It’s about staying in the game. The real danger is abandoning stocks after a crash and missing the rebound. Defensive portfolios are designed to weather storms, not sit on the sidelines. Rebalancing and staying disciplined are more important than picking the perfect stock.

Comments

Defensive investing is basically the financial equivalent of wearing a helmet while biking-you’re not gonna win the Tour de France, but you also won’t be eating pavement when you hit a pothole. The real insight here isn’t the sectors or the ETFs-it’s the psychological architecture. Most people treat markets like slot machines, but defensive portfolios treat them like plumbing: silent, steady, and essential. You don’t celebrate when the water flows; you only notice when it stops. That’s the mindset shift. No hype, no FOMO, just infrastructure. And yeah, Warren Buffett was right-diversification isn’t about being smart, it’s about not being stupid when everyone else is drunk on leverage and crypto memes.

Ugh. Another ‘defensive’ guru peddling the same 2008 playbook like it’s gospel. Let’s be real-this whole ‘buy staples and bonds’ thing only works if you’re a retiree who still uses fax machines. Inflation’s at 4%, interest rates are sticky, and utilities are overvalued because everyone’s chasing safety. Meanwhile, AI infrastructure, clean energy storage, and biotech automation? Those are the real secular trends. You’re not ‘protecting’ yourself-you’re just renting a lifeboat while the Titanic’s got a damn engine. And TIPS? Please. The Fed’s already pricing that in. This advice is like recommending a horse carriage because you’re scared of traffic jams. Pathetic.

Thank you for this. 🙏 I’m 38 and just started investing. I used to chase every ‘hot stock’ and lost money twice. Now I’m slowly moving into XLP and XLV. Not exciting, but peaceful. I sleep better now. 💤