Capital Gains Tax Calculator

Tax Calculation

Results

Short-term gains taxed as ordinary income (up to 37% + 3.8% NIIT)

Long-term gains taxed at 0%, 15%, or 20% based on income level

Why Timing Your Stock Sales Matters More Than You Think

If you’ve ever sold stocks, mutual funds, or real estate and been shocked by your tax bill, you’re not alone. The difference between paying 15% and 37% on the same gain isn’t just a number-it’s thousands, sometimes tens of thousands, of dollars. And the biggest lever you control isn’t your income, your deductions, or even your investment picks. It’s how long you hold your assets before selling.

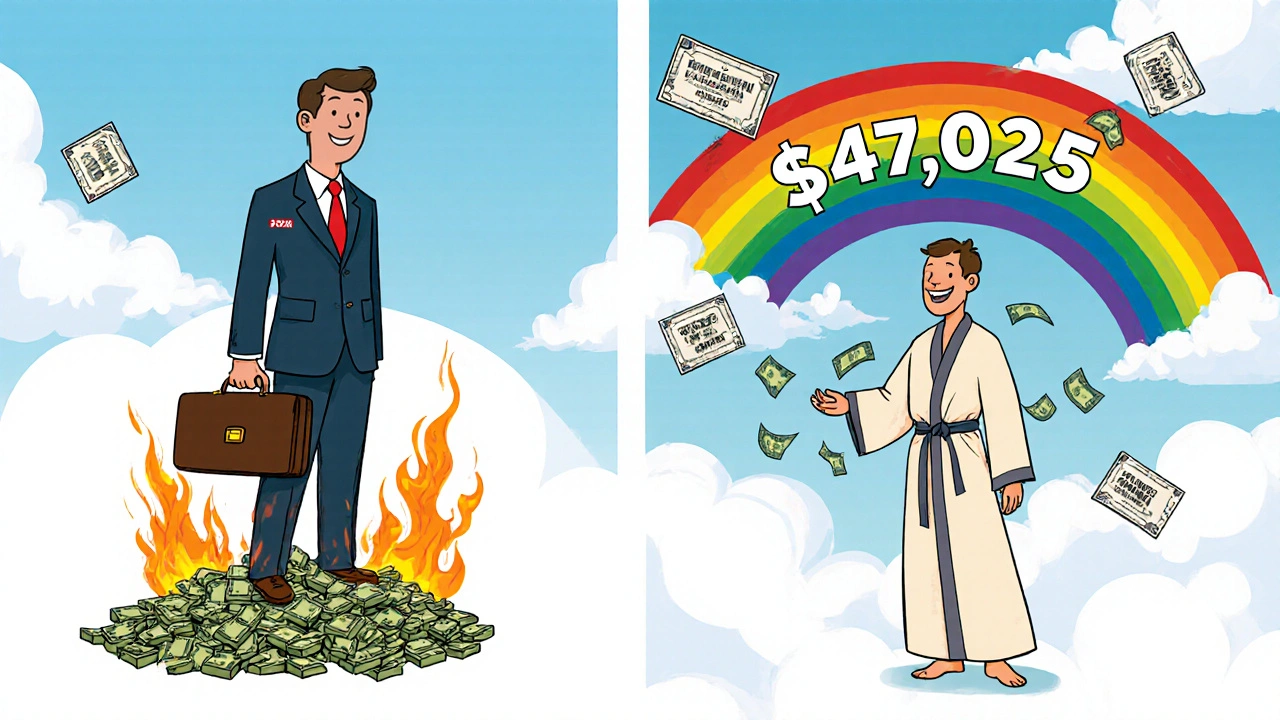

The U.S. tax code gives you a massive break if you wait more than a year. Sell after 366 days? You could pay less than half the tax you’d pay if you sold after 364 days. That’s not a trick. That’s the law. And if you’re sitting on gains, ignoring this rule is like leaving money on the table.

Short-Term vs. Long-Term: The 37% vs. 15% Divide

Here’s the simple truth: if you hold an asset for less than a year, any profit is taxed as ordinary income. That means it gets slapped with the same rate as your salary-up to 37% federally. Add in the 3.8% Net Investment Income Tax (NIIT) if you earn over $200,000 (single) or $250,000 (married), and you’re looking at nearly 41% in federal taxes alone.

Now, hold that same asset for more than a year. Suddenly, your tax rate drops to 0%, 15%, or 20%, depending on your income. For 2024, single filers pay 0% on long-term gains if their taxable income is below $47,025. Even if you make $100,000 a year, you’re still in the 15% bracket for long-term gains-until you hit $518,900.

Let’s say you made $100,000 in profit on a stock you bought last year. If you sold it in November, after only 10 months, you’d owe $37,000 in federal tax (37% rate) plus $3,800 in NIIT-total $40,800. Wait until January, and you’ve held it over a year. Now you pay $15,000 at the 15% rate. That’s a $25,800 savings. Just by waiting.

How the Holding Period Actually Works (No Guesswork)

It’s not enough to say “I held it for a year.” The IRS is exact. Your holding period starts the day after you buy. So if you bought shares on January 1, 2024, you don’t qualify for long-term treatment until January 2, 2025. One extra day matters.

This isn’t theoretical. I’ve seen clients sell on December 30 thinking they’re safe, only to find out their purchase date was December 31 of the prior year. They got hit with short-term rates. One client lost $18,000 because he didn’t check the trade confirmation date.

Use your brokerage’s cost basis report. It shows your purchase date and whether each lot is short-term or long-term. Don’t trust memory. Don’t trust your gut. Trust the document.

Use Your Tax Bracket Like a Weapon

Here’s where most people miss the real opportunity: timing your sales to fit inside the 0% long-term capital gains bracket.

If your taxable income is under $47,025 (single) or $94,050 (married filing jointly), you pay 0% on long-term gains. That means you can sell up to $47,025 in gains and owe nothing. Not $47,025 in income-$47,025 in gains, on top of your other income.

Example: You’re retired, living off $30,000 in Social Security and $10,000 in interest. Your taxable income is $25,000. You can sell $22,025 in appreciated stock this year and pay $0 in federal capital gains tax. That’s $22,025 in profit, tax-free.

That’s not a loophole. That’s the law. And it’s available to far more people than you think. Even if you’re working, if your income is low enough in a given year-say, after a career break or during early retirement-you can use that window to harvest gains without paying a cent.

What About Losses? Don’t Just Harvest-Match Them Right

Tax-loss harvesting gets all the attention. But most people do it wrong. The goal isn’t just to offset gains. It’s to offset the wrong kind of gains.

Long-term losses can only offset long-term gains first, then up to $3,000 of ordinary income. But short-term losses? They can offset short-term gains-which are taxed at your highest rate-and then long-term gains. That’s powerful.

Strategy: If you have a $10,000 short-term gain from a stock you sold too early, look for a $10,000 short-term loss elsewhere. Sell something you’ve held less than a year that’s down. You cancel out the high-taxed gain. You don’t just reduce your tax-you erase it.

David Marolt, a tax advisor in Oregon, puts it bluntly: “Use long-term losses to offset short-term gains, and you cut your effective tax rate by 20-25%.” That’s not advice. That’s math.

When to Sell: January vs. December Makes a Huge Difference

Don’t wait until December to think about taxes. The calendar matters more than you realize.

If you sell a stock in November and trigger a short-term gain, you only have two months left to find losses to offset it. But if you wait until January to sell, you get a full 12 months to harvest losses. That’s not just timing-it’s strategy.

Here’s a real tactic: If you’re planning to sell a stock that’s been held less than a year, hold off until January. You’ll avoid short-term gains this year entirely. And if the stock drops in December, you can sell it then for a loss and buy it back in January-after the 30-day wash-sale window closes.

Wash-sale rule alert: You can’t buy the same stock back within 30 days and claim the loss. But you can buy a similar ETF or index fund. Sell Apple, buy the S&P 500 ETF. Same exposure, different security. No penalty.

High Earners: State Taxes Can Double Your Bill

Federal rates are bad enough. But if you live in California, New Jersey, or Minnesota, your state tax can add another 9-13.3%.

That means a $100,000 short-term gain in California could cost you $40,800 in federal tax + $13,300 in state tax = $54,100 total. That’s over half your profit gone.

One client moved from California to Texas in June, sold his stock in October, and saved $13,000 in state taxes alone. He didn’t change his investments. He just changed his address before the sale.

It’s legal. It’s smart. And it’s not just for the ultra-rich. If you’re thinking about relocating anyway-retiring, remote work, family reasons-timing the move before a big sale can pay for the move itself.

Special Cases: Real Estate, Dividends, and Equity Awards

Not all assets are created equal.

- Real estate: If you’ve claimed depreciation, part of your gain is taxed at 25% (recapture), even if it’s long-term.

- Qualified dividends: These are taxed at long-term capital gains rates, so hold your dividend stocks longer to save.

- Stock options and RSUs: If you’re an employee with equity compensation, holding shares for over a year after vesting can turn ordinary income into long-term gains. This alone can save 15-20% in taxes.

For executives and tech workers, this isn’t optional. It’s the difference between keeping half your bonus or just a third.

What’s Changing? Don’t Get Caught Off Guard

Right now, the tax breaks on long-term gains are set to expire after 2025. The 2017 Tax Cuts and Jobs Act lowered rates, but those cuts sunsetting means ordinary income tax rates could rise again.

Plus, President Biden’s 2024 budget proposal wants to tax long-term gains as ordinary income for people earning over $1 million. That would wipe out the biggest advantage you have.

Here’s what to do: If you’re in a high-income bracket and have large unrealized gains, consider selling some before the end of 2025. Lock in today’s rates. Don’t wait for Congress to act. Markets move fast. Tax laws move faster.

Tools Are Here-You Don’t Need a Wall Street Team

Five years ago, only hedge funds and ultra-rich clients had software to optimize tax lots. Now, platforms like FileLater, TaxJar, and even better brokerage tools do it for you.

These systems scan your entire portfolio, identify which lots to sell to minimize taxes, and even suggest when to harvest losses. Some can handle thousands of positions in seconds. They’re not perfect-but they’re better than guessing.

Most brokerages now offer cost basis reports and tax simulations. Use them. Run a “what if” scenario: What if I sell this stock now? What if I wait until January? What if I sell $20,000 of gains this year?

It’s not complicated. It’s just not something most people ever think to do.

Final Rule: Don’t Let Fear or Laziness Cost You

The biggest mistake? Not selling because you’re afraid of the tax bill. That’s like refusing to drive because you’re scared of the gas station.

You don’t have to sell everything. You don’t have to time the market. You just have to hold long enough. And if you’re sitting on gains, you’re already ahead. Now make sure you keep what you’ve earned.

Check your holdings. Run the numbers. Wait one more month if you’re close to the one-year mark. Sell in January if you can. Use your tax bracket. Match your losses. Move if it makes sense.

Tax efficiency isn’t about being rich. It’s about being smart with what you’ve got.

Comments

Bro, I literally just sold a stock on December 30th thinking I was safe-turns out I bought it on December 31st last year. IRS didn’t give a fuck. I got nailed with 37% instead of 15%. $18k down the toilet. Don’t be me. Check your damn trade confirmations. Your brokerage’s cost basis report isn’t a suggestion-it’s your only friend when the taxman knocks.

This is one of the clearest breakdowns of tax timing I’ve ever read. Seriously, the 0% long-term bracket trick is something so many people overlook-even those who think they’re financially literate. I’m retired with modest income, and last year I sold $20k in gains and paid $0 in federal tax. It felt like finding free money in my couch cushions. The key isn’t complexity-it’s awareness. Use your broker’s tax tools. Run the simulations. It takes 15 minutes and can save you thousands. Don’t let inertia cost you what you’ve earned.

👌 this is gold. i hold stocks for >1yr now. no more short-term pain. 🙏