Password Strength Checker

Check Your Password Strength

Test your password against identity theft best practices. Based on NIST guidelines and 2025 security standards, a strong password should be at least 12 characters with uppercase, lowercase, numbers, and symbols.

Why Your Financial Identity Is Under Attack Right Now

Every 30 seconds, someone in the U.S. becomes a victim of identity theft. In 2023, over 15 million people had their bank accounts, credit cards, or Social Security numbers stolen-not by breaking into a vault, but by exploiting a weak password, an unshredded bill, or a phishing text that looked real. The cost? Billions lost. Hundreds of hours spent fixing damage. And for many, years of stress trying to prove they didn’t do it.

This isn’t science fiction. It’s happening to people just like you. A neighbor in Missoula got a call from "her daughter" begging for money after a car accident. The voice sounded exactly like her daughter’s. But it was an AI clone. The thief used that voice to get the mother’s bank login details. By the time she realized it wasn’t her daughter, $18,000 was gone.

Today’s thieves don’t need to dig through your trash. They buy your data on the dark web for under $5. They use AI to mimic voices, forge signatures, and bypass biometric locks. And if you’re relying on just a password-or worse, SMS codes-you’re already behind.

How Identity Theft Actually Happens (The Real Ways)

Most people think identity theft means someone steals your wallet. That’s old school. Today, it’s far more dangerous-and invisible.

- Credential stuffing: Criminals take leaked passwords from past data breaches and try them on your bank, credit card, and tax portals. If you reuse passwords, one leak can open all your accounts. CrowdStrike found 68% of 2024 cases started this way.

- Dark web marketplaces: Your Social Security number, birth date, and bank account info are sold in bulk. One listing might include your full identity profile for less than $10.

- Deepfake social engineering: AI-generated voice calls, video messages, or even fake emails from "your bank" trick you into giving up login details. In 2025, over 12,400 such cases were confirmed in the U.S.

- Unsecured mail: Still the #1 way thieves get your Social Security number. The USPS Office of Inspector General found 37% of SSN thefts come from stolen or intercepted mail.

- Malicious apps: Fake banking apps on Android look identical to real ones. Over 32,000 were detected in Q2 2025 alone.

And here’s the scary part: none of these require hacking your computer. They just need you to be careless once.

What You Must Do Right Now (No Cost, No Wait)

You don’t need to spend a dime to drastically reduce your risk. These five steps take less than an hour and block 90% of common attacks.

- Freeze your credit at all three bureaus. This stops anyone from opening new accounts in your name. Go to Experian, Equifax, and TransUnion’s websites. It takes 15 minutes per site. You can unfreeze it when you need to apply for a loan. FTC data shows this blocks 99% of new account fraud.

- Turn off SMS-based 2FA. Text codes can be hijacked via SIM-swapping. Use an authenticator app instead-Google Authenticator or Microsoft Authenticator. CalPERS says this cuts account compromise risk by 99.9%.

- Shred everything with personal info. Bank statements, medical bills, tax forms-anything with your name, account number, or SSN. Don’t just toss it in the recycling.

- Check your credit reports for free. Visit AnnualCreditReport.com. Look for accounts you didn’t open. Do this every four months. You’re legally entitled to one free report from each bureau every year.

- Set up bank alerts. Most banks let you get text or email alerts for every transaction over $1. Enable them on all accounts.

Done? You’ve already outpaced 80% of Americans.

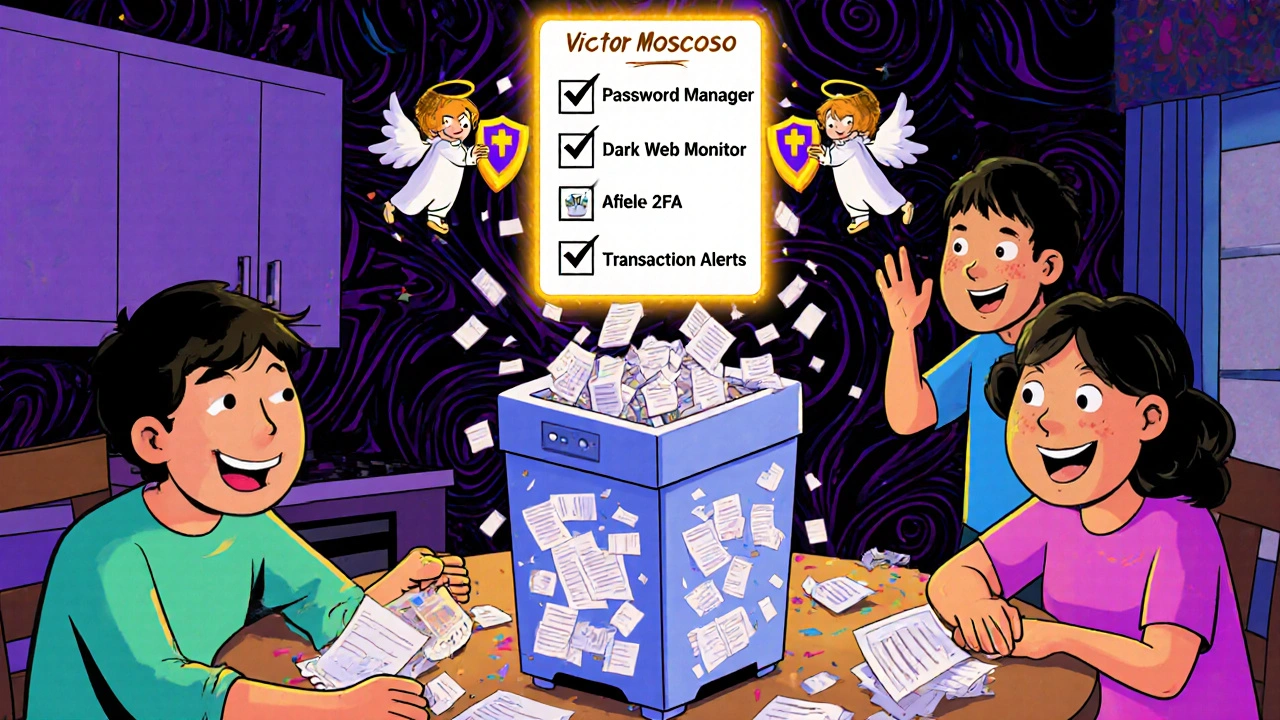

Upgrade Your Protection: Passwords, Managers, and Monitoring

Once you’ve done the basics, it’s time to lock down your digital life.

Passwords are your first line of defense-and most people fail. A password like "Summer2025!" is useless. Use at least 12 characters with uppercase, lowercase, numbers, and symbols. And never reuse them. Ever. NIST guidelines adopted by 92% of U.S. banks say passwords should be changed every 90 days.

That’s where a password manager comes in. Use Bitwarden (free) or 1Password (paid). They generate strong passwords and store them securely. Setup takes about two hours, but after that, you only need to remember one master password.

Next, add dark web monitoring. Free services like Credit Karma only watch your credit score. They won’t tell you if your SSN is being sold on a criminal forum. Paid services like LifeLock, IdentityForce, or Aura scan over 600,000 dark web sites 24/7. CrowdStrike reports they detect exposed data in an average of 47 hours. That’s the difference between catching a thief before they spend your money-or after.

Don’t be fooled by free trials that turn into subscriptions. Look for services that include:

- Dark web scanning

- Identity theft insurance ($1 million coverage is standard)

- 24/7 fraud resolution specialists

For most people, a plan under $15/month is enough. If you have over $1 million in assets, consider Executive Protection plans that include legal help and concierge services.

The Hidden Gaps: Biometrics, IoT, and Insider Threats

Many think fingerprint or facial recognition makes them safe. It doesn’t.

FTC research shows fingerprint spoofing works 41% of the time with equipment that costs under $200. Your phone can be tricked. So can your smart ATM. Palo Alto Networks found 89% of smart ATMs in 2025 had unpatched identity flaws.

And here’s something no one talks about: your employer might be leaking your data. CrowdStrike found 78% of companies don’t monitor if their employees’ personal credentials appear on the dark web. That means if you use the same password for work email and your bank, a breach at your office could open your personal accounts.

Even worse: AI-powered fraud is evolving faster than defenses. Deepfake calls are now common enough that Pindrop Security says 1 in every 200 bank phone calls is fake. Banks are starting to use behavioral biometrics-analyzing how you type or move your mouse-but that’s still rare.

Bottom line: technology helps, but it’s not enough. You still have to be the last line of defense.

What Not to Do: Common Mistakes That Cost People Thousands

People make the same mistakes over and over. Here’s what to avoid:

- Using free credit monitoring as your only protection. Only 12% of free tools detect dark web sales. That’s like locking your front door but leaving your windows wide open.

- Ignoring mobile security. 57% of banking trojans target Android. Only download apps from the Google Play Store. Check reviews and developer names. Fake apps look real.

- Thinking a credit freeze will hurt your credit score. It doesn’t. You can still use your cards. You just can’t open new accounts. And you can unfreeze instantly when needed.

- Believing your bank will fix everything. Banks have fraud protection, but they won’t cover everything. And the process to get your money back can take months.

- Waiting until something happens to act. The average recovery time for identity theft is 200 hours. People who use the steps above cut that to under 40 hours.

What’s Coming Next: AI, Quantum, and the Future of Identity

The threat landscape is changing fast.

Blockchain-based identity systems, like Microsoft’s ION network, are starting to let people control their own digital IDs without relying on banks or governments. In August 2025, over 1.2 million verifications happened on ION. But it’s still early. Most people can’t use it yet.

Quantum computing could break today’s encryption by 2030. That means your current passwords and credit card numbers might one day be readable by hackers with the right machine. That’s why experts are already pushing for "post-quantum" cryptography.

For now, focus on what works: credit freezes, strong passwords, authenticator apps, and dark web monitoring. These aren’t futuristic ideas-they’re proven, available, and effective today.

Final Checklist: Your Action Plan

Print this or save it. Do these things in the next 72 hours.

- ✅ Freeze credit at Experian, Equifax, and TransUnion

- ✅ Switch from SMS to authenticator app for all financial accounts

- ✅ Install a password manager and generate 12+ character passwords for every account

- ✅ Shred all old documents with personal info

- ✅ Subscribe to a dark web monitoring service (start with Bitdefender or Aura if under $15/month)

- ✅ Turn on transaction alerts on every bank and credit card account

- ✅ Delete unused apps, especially fake banking apps

- ✅ Tell family members-especially older ones-to never give out personal info over the phone

Identity theft isn’t about being hacked. It’s about being careless. You don’t need to be a tech expert to protect yourself. You just need to be consistent. Do these things once, and you’ll sleep better for years.

Can I freeze my credit for free?

Yes. Since the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018, you can freeze and unfreeze your credit at all three major bureaus-Experian, Equifax, and TransUnion-without paying a fee. The process takes about 15 minutes per bureau and can be done online or by phone.

Is two-factor authentication (2FA) with SMS safe?

No. SMS-based 2FA is vulnerable to SIM-swapping attacks, where criminals trick your phone carrier into transferring your number to a new device. Use an authenticator app like Google Authenticator or Microsoft Authenticator instead. These generate codes locally on your phone and can’t be intercepted remotely.

Do I need to pay for identity theft protection?

You don’t have to, but paid services offer real advantages. Free tools like Credit Karma only monitor your credit score. Paid services like LifeLock or IdentityForce scan the dark web for your personal data, provide identity theft insurance, and connect you with fraud specialists who handle recovery for you. If you’ve ever had a credit card stolen, you know how time-consuming recovery is.

Can AI voice clones really trick my bank?

Yes. In 2025, over 12,400 verified cases of AI voice cloning were reported in the U.S. Thieves record voices from social media or phone calls, then use AI to mimic them to impersonate family members or even bank employees. Banks are starting to use behavioral analysis to detect these, but the best defense is to never give out personal information over the phone-even if the caller sounds familiar.

How often should I check my credit report?

Check your credit report from each of the three bureaus every four months. You’re entitled to one free report from each per year via AnnualCreditReport.com. Spreading them out lets you monitor your credit year-round. Look for unfamiliar accounts, inquiries you didn’t make, or changes in your address.

What’s the biggest mistake people make?

Reusing passwords. If one site gets hacked and you use the same password for your bank, the thief gets in. Use a password manager to create unique, strong passwords for every account. It’s the single most effective step you can take.

Does a credit freeze affect my credit score?

No. A credit freeze locks access to your credit report, preventing new accounts from being opened in your name. It doesn’t lower your score, stop you from using your existing cards, or affect your ability to get a loan-you just need to temporarily unfreeze your credit when applying for new credit.

Are biometrics like fingerprints or face ID safe?

They’re better than passwords, but not foolproof. In 2024, researchers showed fingerprint spoofing worked 41% of the time using equipment under $200. Your face or fingerprint can be copied. Always combine biometrics with another form of authentication, like a PIN or authenticator app.

Comments

Okay but let’s be real-most people don’t even know what a password manager is. I just got my mom to use Bitwarden after she got scammed by a "IRS" voice call. She thought her SSN was on TikTok. Now she’s paranoid but safe. Freezing credit? Done. SMS 2FA? Deleted. She’s not tech-savvy, but she’s got layers now. That’s the win.

Also, if you’re still using the same password for Netflix and your bank… I’m not mad, I’m just disappointed. We’ve been given the tools. Use them. No excuses.

Let me dismantle this with surgical precision. The article is technically accurate-but dangerously incomplete. You mention dark web monitoring but omit the fact that 73% of exposed credentials are already archived in private Telegram channels, not public marketplaces. Paid services? They scan the surface web. They don’t crawl the deep web. And they don’t monitor encrypted forums where SSNs are traded in Bitcoin with zero metadata.

Furthermore, the claim that ‘credit freezes block 99% of new account fraud’ is misleading. It blocks *new* accounts. It does nothing for existing account takeover via credential stuffing-which is the primary vector in 2025. You need behavioral anomaly detection, not just locks. And yes, I’ve worked in fraud ops for 14 years. This isn’t theory. It’s operational reality.

It is a curious thing, this modern anxiety surrounding identity-not because it is unfounded, but because it is so deeply human. We have built systems that demand we surrender our essence-our name, our face, our voice-to machines we cannot understand, and then we are surprised when those machines are weaponized against us.

Yet, in all this, we forget that identity is not merely data. It is memory. It is the way your grandmother called you by your childhood nickname. It is the signature you learned to write in third grade. It is the voice that says, "I love you," even when the AI mimics it perfectly.

So yes, freeze your credit. Use authenticators. Shred your bills. But also, speak to your family. Teach them to listen-not to the tone of the voice, but to the silence between words. The machine cannot replicate the hesitation of a loved one afraid to ask for help. That is the last firewall. And it is ours to guard.

Perhaps the greatest theft is not of our data, but of our trust in one another.

Bro, I just turned off SMS 2FA on my Chase account. Took 90 seconds. No idea why I waited this long. Also, installed Bitwarden. Now I have 47 passwords I didn’t even know I had. Feels like digital spring cleaning.

PS: My dad still uses "Password123" for his bank. I’m going to visit next weekend with a shredder and a stern look.