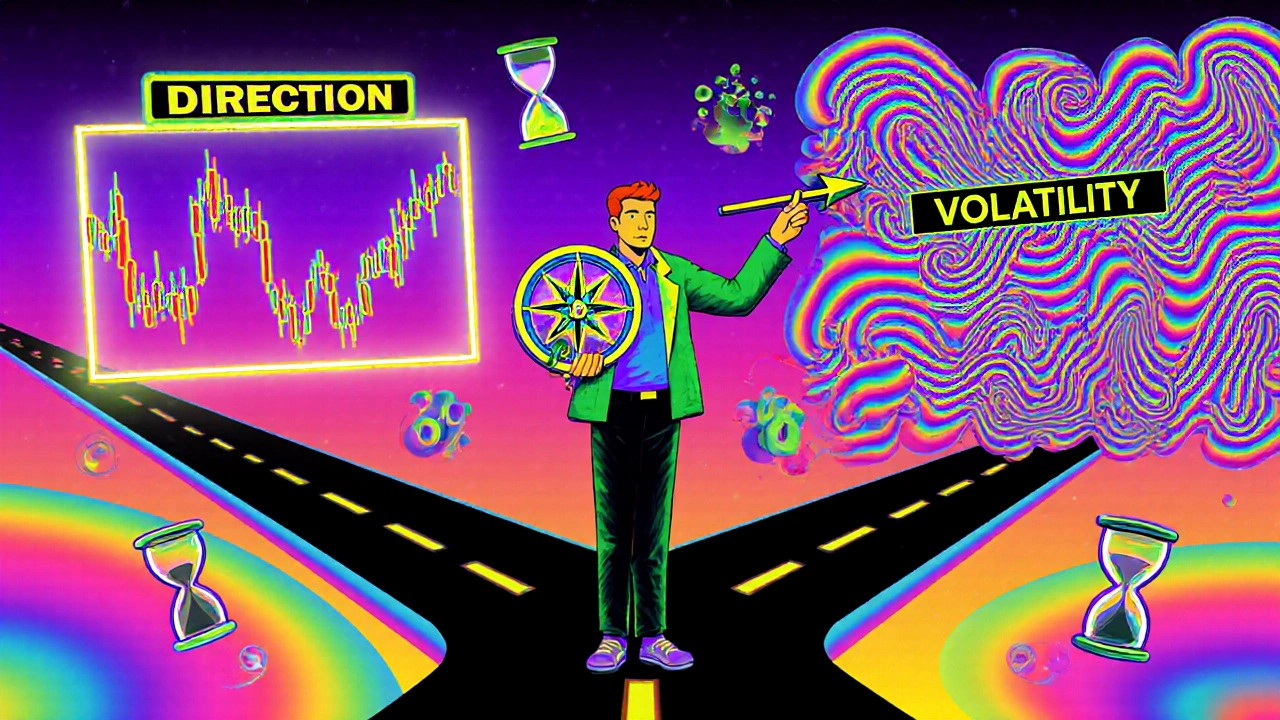

Long Straddle: How to Profit from Market Volatility Without Predicting Direction

A long straddle, a neutral options strategy that profits from large price swings in either direction. Also known as a buy straddle, it’s one of the few trades where you don’t need to know if a stock will go up or down—you just need it to move a lot. This strategy combines buying a call option and a put option on the same stock, with the same strike price and expiration date. It’s not for beginners who just want to buy and hold. It’s for people who see big moves coming—earnings reports, Fed announcements, or product launches—and want to profit whether the news is good or bad.

What makes a long straddle work isn’t luck—it’s timing and volatility. If a stock trades at $100, you buy a $100 call and a $100 put. If the stock jumps to $120, your call pays off. If it crashes to $80, your put saves you. The catch? Both options cost money upfront. You need the stock to move far enough to cover those costs plus fees. That’s where implied volatility comes in. High implied volatility means options are expensive, but it also means the market expects a big move. Buying a straddle before a known event—like a drug trial result or a merger announcement—is a classic use case. After the event, if volatility drops and the stock doesn’t move enough, you lose. That’s why most people who use this strategy watch the VIX and earnings calendars like a hawk.

You’ll also find that options trading isn’t just about picking winners. It’s about managing risk with precision. A long straddle has a defined maximum loss (the total premium paid) and unlimited profit potential. That’s rare in finance. But it’s not a free lunch. You need to know when to exit. Holding too long after the big move fades is how people give back their profits. That’s why many traders use this strategy in the week before earnings, then close it within 24 hours of the announcement—win or lose.

The posts below show real examples of how this plays out. You’ll see how traders use long straddles around Fed rate decisions, how they adjust for changing volatility, and why some people avoid them entirely unless they’re certain a move is coming. You’ll also find tools and tips for spotting the right moments—when implied volatility is low before a big event, or when a stock has been stuck in a range for weeks. This isn’t about gambling. It’s about betting on chaos, and having a plan when it arrives.