Online Scams 2025: How to Spot and Avoid the Latest Financial Fraud Tactics

When you hear online scams 2025, modern digital fraud schemes designed to steal money, personal data, or investment funds through deceptive websites, apps, or messages. Also known as digital financial fraud, these scams don’t just target the elderly anymore—they’re built to fool anyone who trusts a sleek app, a glowing testimonial, or a "limited-time" offer. The most dangerous ones now look like real investment platforms, complete with fake SEC logos, fake customer support chats, and even fake performance reports that beat the S&P 500. You’re not being paranoid if you double-check. You’re being smart.

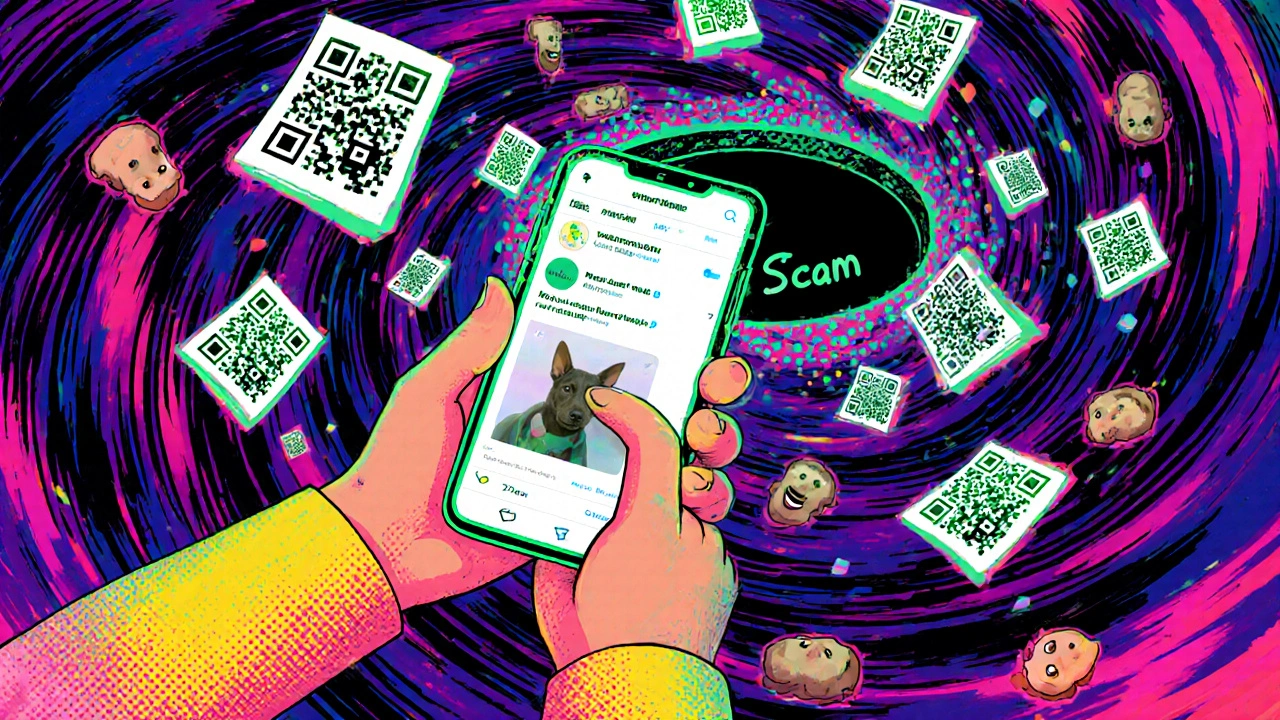

These scams rely on three things: urgency, authority, and invisibility. phishing scams, fraudulent messages designed to trick you into giving up passwords, account details, or two-factor codes. Also known as email or SMS fraud, they’ve moved beyond generic "Dear Customer" emails and now use AI to mimic your broker’s tone, even referencing your recent trades. Then there’s investment scams, fake crypto projects, robo-advisor clones, or "guaranteed return" ETFs that don’t exist. Also known as Ponzi-style investment fraud, they lure people with promises of 20% monthly returns—and vanish once you deposit more than $5,000. And don’t forget identity theft, the theft of your personal data to open accounts, apply for loans, or drain your existing ones. Also known as financial identity fraud, it’s often the hidden cost of falling for one of these scams. These aren’t separate problems—they’re connected. One fake app steals your login. That login gets sold. Then your credit is drained. Your bank calls. By then, it’s too late.

The good news? You don’t need to be a tech expert to protect yourself. Every post in this collection is built from real cases—people who lost money because they trusted a logo, a YouTube ad, or a "verified" account. You’ll find guides on spotting fake fee disclosures, checking if a robo-advisor is legit, and why your broker’s cash account is safer than that shiny new app promising 7% interest. You’ll learn how to verify a company’s registration, what to look for in a KYC process, and why a "no minimum" investment platform with no physical address is a red flag. This isn’t theory. It’s what happened to real investors in 2024 and 2025—and how they stopped it before it got worse.