Trading Signals: What They Are and How Real Traders Use Them

When you hear trading signals, automatic or manual alerts that suggest when to enter or exit a trade based on price patterns, volume, or indicators. Also known as trade alerts, they’re meant to cut through market noise and give you a clear action plan. But most people don’t realize that a signal is only as good as the system behind it. A simple moving average crossover isn’t magic—it’s math. And that math only works if it fits your strategy, timeline, and risk tolerance.

Trading signals rely on technical analysis, the study of price charts and historical market data to predict future movements. That means looking at things like chart patterns, repeating shapes like head and shoulders, triangles, or double tops that traders use to anticipate reversals or breakouts. But here’s the catch: if everyone sees the same pattern, the market already priced it in. The real edge comes from combining signals with context—like volume spikes, news events, or how the broader market is behaving. You can’t just follow a red arrow on a screen and expect to win.

Some traders use algorithmic trading, automated systems that generate signals based on coded rules, often running on servers 24/7. These aren’t sci-fi—they’re used by hedge funds and retail traders alike. But even the best algorithms fail if they’re not tested under real conditions. Backtesting on past data doesn’t guarantee future results. What matters is how the signal performs when volatility spikes, liquidity dries up, or the Fed makes an unexpected move. That’s why the most successful traders don’t just follow signals—they question them.

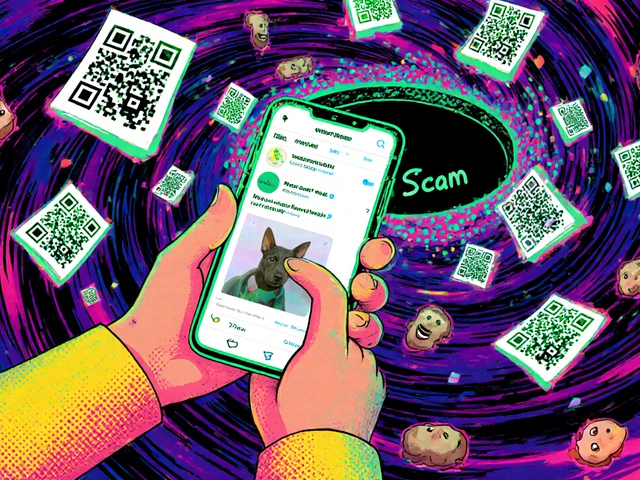

And then there’s the noise. Email lists promising 80% win rates. Telegram groups selling "guaranteed" buy signals for Bitcoin. These aren’t tools—they’re distractions. Real trading signals aren’t about luck. They’re about consistency, discipline, and understanding the limitations of any indicator. A RSI reading of 70 doesn’t mean sell. It means: "Look closer." A breakout above resistance doesn’t mean buy. It means: "Check the volume, check the trend, check your risk."

What you’ll find here isn’t a list of magic formulas. It’s a collection of real breakdowns—how signals work in options, how they fail in volatile markets, how they interact with macro trends like interest rates or currency shifts. You’ll see how traders actually use them—not the hype, not the ads, but the gritty details behind the alerts. Whether you’re tracking Treasury yields, crypto volatility, or global stock moves, the goal is the same: turn signals into decisions, not guesses.