BNPL Charge-Off Risk Calculator

Important Note: This calculator provides an estimate based on industry data from the article. Actual risk may vary based on individual circumstances. BNPL charge-offs can lead to fees, collections, and credit score impacts.

Buy Now, Pay Later (BNPL) seems simple: split your purchase into four payments, no interest, instant approval. But behind the scenes, lenders are watching a quiet shift in how people pay - and it’s not all good. As of Q1 2025, BNPL charge-off rates are climbing. Not dramatically yet, but steadily. And for providers like Affirm and Klarna, that’s starting to matter.

What Exactly Is a BNPL Charge-Off?

A charge-off happens when a lender decides a loan is unlikely to be repaid. For BNPL, that usually means 120+ days past due. Once that threshold is hit, the debt gets written off the books as a loss. It doesn’t mean the borrower is off the hook - collections may still follow - but the lender stops counting it as an active asset. This isn’t like credit cards, where you can miss a payment and get a grace period. Most BNPL services auto-debit your bank account or card. If that fails, the system tries again. But if it keeps failing? That’s when the clock starts ticking toward charge-off.The Numbers Don’t Tell the Whole Story

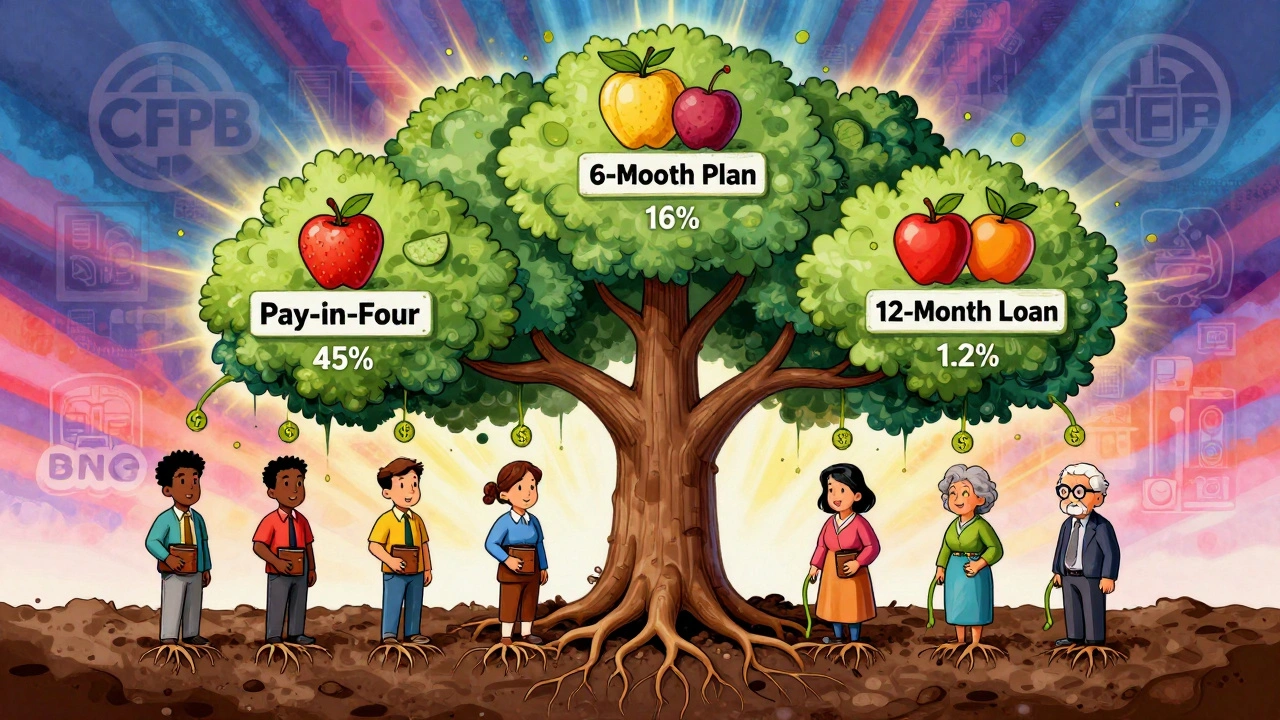

On the surface, BNPL looks safe. The Consumer Financial Protection Bureau (CFPB) reported average charge-off rates between 0.51% and 0.54% for major providers like Klarna from 2019 to 2022. That’s far below the 2.5%-3.0% default rate for credit cards. So why the concern? Because those averages hide extreme risk splits. Super-prime borrowers (credit scores above 720) have charge-off rates as low as 0.8%. But for Deep Subprime borrowers (scores under 580)? That number jumps to 45%. Affirm’s Q1 2025 report showed 3.8% of its portfolio was at least 30 days late - up from 3.4% a year earlier. Klarna’s charge-off rate rose from 0.51% to 0.54% in the same period. That’s a 17% increase in credit losses year-over-year. Not a crisis yet, but a clear signal.Pay-in-Four Isn’t the Whole Game

Most BNPL transactions - about 85% - are the classic “pay in four” model: 25% upfront, then three biweekly payments. For this product, charge-off rates vary wildly by credit tier:- Deep Subprime: 45.0%

- Subprime: 16.0%

- Near Prime: 12.7%

- Prime: 13.2%

- Super-prime: 9.1%

Who’s Using BNPL - And Who’s Defaulting?

BNPL isn’t just for tech-savvy millennials. It’s being used by people who don’t qualify for traditional credit. The Federal Reserve Bank of Boston and CFPB found that women, Black and Latino consumers, households earning $20,001-$50,000, and people with credit scores below 620 are 2.3 times more likely to use BNPL. And they’re also 37% more likely to default. Users under 25 have charge-off rates of 1.8%. Those over 55? Just 0.3%. Gen Z and millennials make up 68% of BNPL users - and 54% of all delinquencies. This isn’t accidental. BNPL providers target younger shoppers with ads on TikTok, Instagram, and during checkout on Shopify stores. But when rent, groceries, and car payments come due, those $50 impulse buys add up fast. Reddit threads like “BNPL horror stories” are full of users juggling seven or eight payments. One user wrote: “I have 7 active Klarna payments and missed 3 this month - now I’m hit with $35 in late fees plus overdraft charges.”Why Charge-Offs Are Rising - And What’s Being Done

There are three big reasons BNPL charge-offs are climbing:- Liquidity crunches. With $1.2 trillion in U.S. credit card debt and BNPL adding another $143 billion, many users are stretching thin. When income dips or an emergency hits, BNPL payments are often the first to slip.

- Counteroffers delay, but don’t fix. Providers like Klarna and Affirm increasingly offer “modified payment plans” when users miss payments. This pushes charge-offs further out, making the numbers look better than they are. But the debt doesn’t disappear.

- Low financial literacy. The FTC found 68% of BNPL users don’t know missed payments can trigger collections. Half believe it doesn’t affect their credit score - even though longer-term BNPL loans often do.

Regulators Are Watching - And Acting

The CFPB’s January 2025 report was a wake-up call. It didn’t just report numbers - it called BNPL’s lack of transparency a risk. Unlike credit cards, BNPL providers aren’t required to report to credit bureaus consistently. That means many users don’t realize their missed payments could hurt their score - or that they’re building debt they can’t track. California passed AB 1867 in January 2026, forcing BNPL lenders to run affordability checks - just like credit card issuers. Other states are following. The CFPB is also moving to classify BNPL as a credit product under the Truth in Lending Act by Q3 2026. That would mean:- Clearer disclosures on interest and fees

- Consistent credit reporting

- Ability to dispute errors

What This Means for You

If you’re using BNPL:- Know your total obligations. Don’t just look at one payment - tally them all.

- Understand the consequences. Missed payments can lead to collections, fees, and credit damage - especially with longer-term plans.

- Check if your provider reports to credit bureaus. If it does, treat it like a loan.

- Avoid BNPL for essentials. Groceries, gas, and rent shouldn’t be split into installments.

- Set minimum order values. Affirm recommends $150+ to keep charge-offs under 0.5%.

- Watch your return rates. BNPL buyers return more - and that eats into your margins.

- Don’t push it on every purchase. Klarna’s internal rule? Avoid BNPL for items under $35.

The Future of BNPL: Growth With Limits

The BNPL market hit $492.6 billion in transaction volume in Q1 2025 and is projected to hit $560 billion by year-end. It’s growing fast. But so are defaults. Experts warn that without tighter rules, charge-off rates could hit 1.2%-1.5% by 2027 - closing the gap with credit cards. The Kansas City Fed calls BNPL an “emerging vulnerability.” The Federal Reserve’s May 2025 Financial Stability Report says it could become a systemic risk if charge-offs spike during a recession. BNPL isn’t going away. It’s too convenient, too embedded in e-commerce. But the days of “no credit check, no consequences” are ending. Providers are adjusting. Regulators are stepping in. And borrowers? They need to start treating these payments like real debt.What’s Next?

If you’re using BNPL regularly, take stock now. List every active payment. Check your bank statements for auto-debits. If you’re struggling, reach out to your provider before you miss a payment - many offer grace periods or adjustments if you ask early. If you’re a merchant, review your BNPL performance data. Are returns high? Are charge-offs creeping up? Consider tightening your eligibility rules or reducing BNPL visibility on low-ticket items. The system isn’t broken - yet. But it’s changing. And the people who adapt first will be the ones who stay ahead.What is a BNPL charge-off rate?

A BNPL charge-off rate is the percentage of loans that lenders write off as uncollectible after a borrower has been delinquent for 120 days or more. It’s a key indicator of how many customers are failing to repay their BNPL agreements.

Are BNPL charge-off rates higher than credit card defaults?

Overall, no - BNPL charge-off rates are still lower than credit card defaults, which hover around 2.5%-3.0%. But that’s only true for the average. For high-risk borrowers, BNPL charge-offs can reach 45%, far exceeding credit card defaults in that group.

Why are BNPL charge-offs rising in 2025?

Charge-offs are rising because more people are using BNPL for everyday purchases, not just big-ticket items. Many users are juggling multiple payments, and with rising living costs, they’re missing payments. Providers are also using counteroffers to delay defaults, which masks the true level of risk.

Does using BNPL hurt your credit score?

It depends. Most pay-in-four BNPL plans don’t report to credit bureaus - but longer-term plans often do. If you miss payments and the lender reports it, your score can drop. Affirm will start reporting all loans to all three bureaus in September 2025, and others may follow.

Should I avoid BNPL altogether?

Not necessarily. BNPL can be useful for planned purchases if you’re confident you can pay on time. But don’t use it for essentials like groceries or rent. Track all your BNPL balances, avoid multiple providers, and never let it become a crutch for living beyond your means.

How do merchants reduce BNPL charge-offs?

Merchants can reduce charge-offs by setting minimum purchase amounts (like $150), limiting BNPL offers on low-ticket items, and using stricter underwriting tools. Shopify’s Shop Pay, for example, approves only about 78% of applications to keep charge-offs below 0.4%.

Comments

bro i had 8 klarna payments going at once 😅 missed one and got hit with $40 in fees + overdraft 💸 now i just pay cash or wait. BNPL is a trap for people who think "it’s just $10" but it’s 10 x $10 = rent money gone. 🚨

OMG this is why i hate how they target teens on tiktok. "buy that $200 hoodie now, pay later!" like duh, you’re 17 and your mom pays your phone bill. they know you don’t know what charge-off means. and now? i got a cousin with 12 BNPL debts and zero credit score. they’re not helping. they’re harvesting. 🤡

i just checked my klarna app… 3 payments. one for a toaster i returned but they still charged me. called them. they said "oh we’ll fix it" and it took 3 weeks. i just want to cry. why is this so hard? 😔 maybe i’m too chill for this system. but also… why do they make it feel so easy until it’s not?

The structural irony here is profound: BNPL platforms market themselves as alternatives to credit-yet they replicate credit’s most predatory dynamics without its safeguards. The absence of mandatory credit reporting, affordability checks, and transparent APR disclosures creates a regulatory black hole. Consumers are not being empowered; they are being algorithmically segmented into risk tiers, then exploited under the guise of financial inclusion. The rise in charge-offs isn’t a failure of personal finance-it’s a failure of systemic ethics. We’ve outsourced debt collection to Silicon Valley, and now we’re surprised when the algorithm prefers profit over people.

you ever notice how every BNPL company has a logo that looks like a friendly robot holding a dollar sign? and yet they’re all owned by the same 3 hedge funds? and the CFPB? they’re just waiting for the next recession to let it all collapse so they can say "we warned you"? i think this is a controlled demolition. watch: when charge-offs hit 1.5%, the government will "save" the system by bailing out the lenders... and then make YOU pay for it with higher taxes. it’s not finance. it’s a pyramid scheme with a Shopify storefront.