Social Media Scams: How to Spot and Avoid Financial Fraud Online

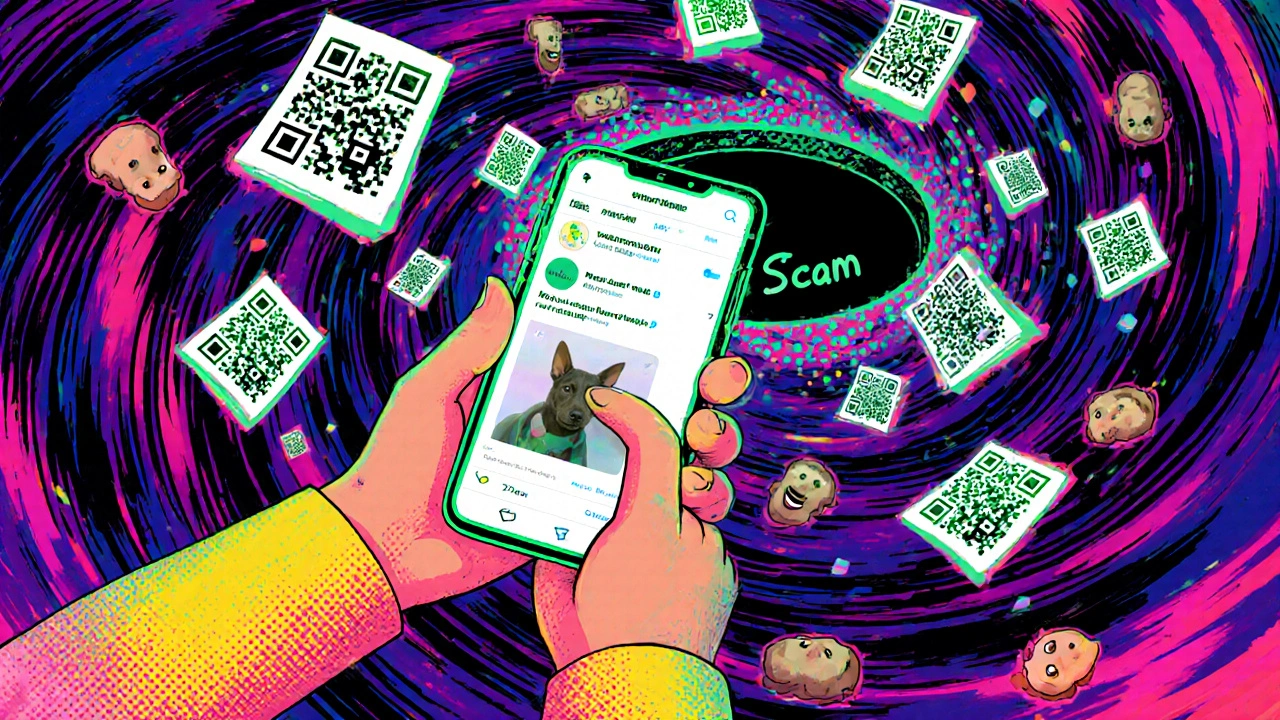

When you see a post claiming you can turn $500 into $5,000 in a week with a simple crypto tip or a "guaranteed" stock pick, you’re not seeing an opportunity—you’re seeing a social media scam, a deceptive scheme designed to trick people into giving up money or personal information through fake promises on platforms like Instagram, TikTok, or X. Also known as online investment fraud, it preys on hope, urgency, and the illusion of insider access. These aren’t just annoying ads—they’re sophisticated operations built to look like real advice from real people.

Behind every fake testimonial is a crypto scam, a fraud where scammers create fake tokens, fake exchanges, or fake influencers to lure victims into sending cryptocurrency that disappears forever. They use bots to flood comments with fake success stories, hire actors to record fake video testimonials, and even build fake websites that look just like real brokerages. And it’s not just crypto—phishing scams, attempts to steal login details by pretending to be your bank, broker, or tax service are rising fast on DMs and fake customer support pages. These scams don’t need to be clever. They just need to be loud enough to catch someone who’s anxious about money.

You won’t find these scams in the fine print of a brokerage statement. They’re in the comments section of a viral video, in the DM from a "financial guru" who just posted a screenshot of their Lamborghini, or in the email that says your account will be frozen unless you click now. The social media scams that work best are the ones that mirror real advice you already trust—until they ask you to send money. That’s the moment everything changes. No legitimate advisor will ever ask you to send cash to a private wallet. No real platform will pressure you with a 24-hour deadline. And no one who’s actually making money is going to post about it on TikTok.

What you’ll find below are real examples of how these scams unfold, the exact red flags that show up in every case, and the simple steps you can take right now to stop them before they touch your account. You’ll see how scammers mimic real financial tools, how they exploit trust in familiar brands, and how even smart people get caught—not because they’re gullible, but because the tricks are designed to feel normal. This isn’t about avoiding the internet. It’s about learning how to move through it safely.